A refreshing approach

Understanding what you’re paying for financial advice isn’t easy. Often the fees you pay are deliberately hidden. That’s why we’ve opted for a refreshingly simple approach. You pay one all-in annual fee for the advice we provide. And that’s it.

Since we don’t sell any financial products or manage your investments, we’re free to give you an honest and unbiased opinion about things many other advisors can’t, like whether you actually need that expensive life insurance policy or how much you’re paying your investment manager and whether they’re worth it.

Aligning our interests

Unlike most advisors, we publish our pricing directly on our website. Think about it, when was the last time you saw that?!

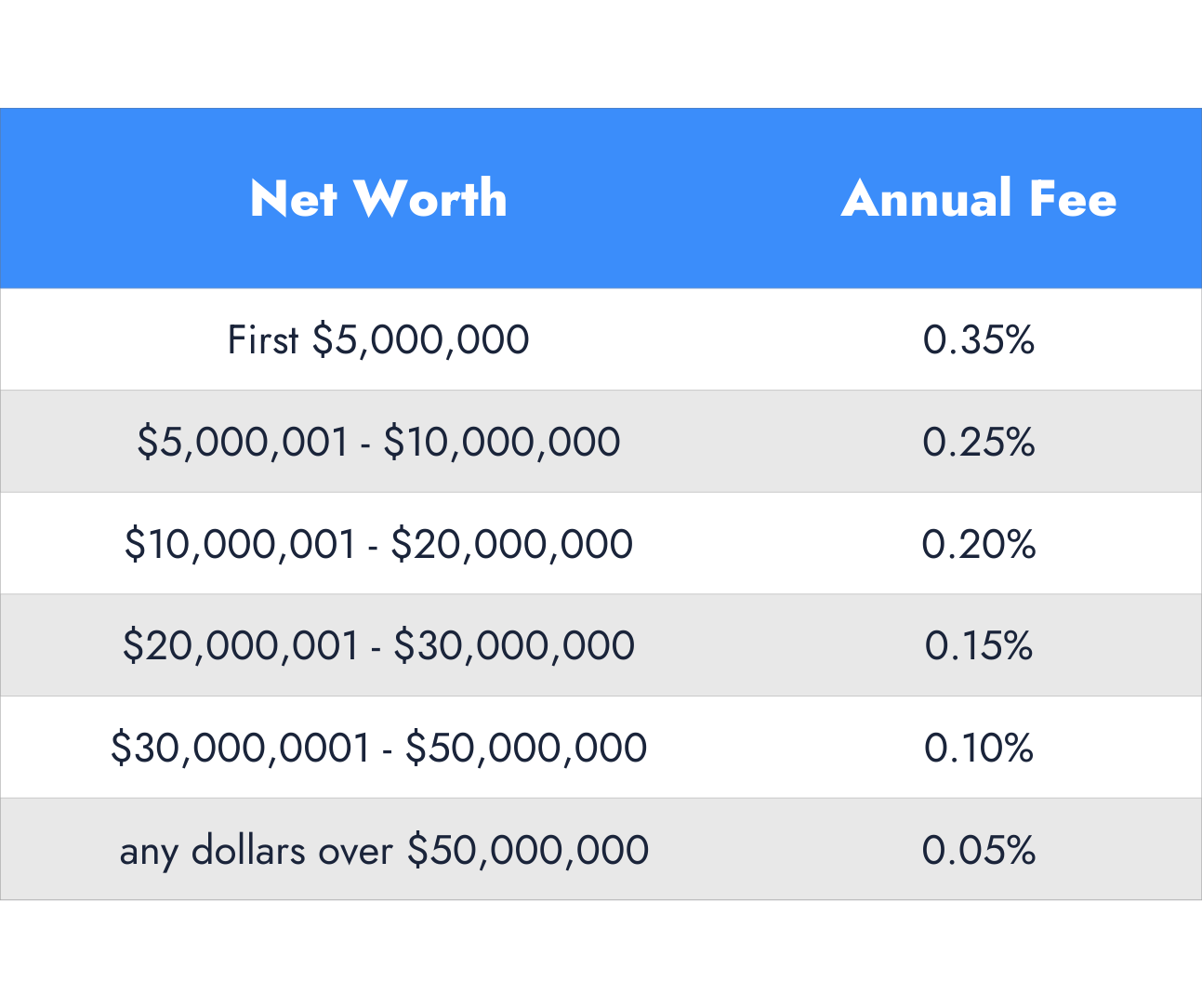

Also, our approach is unique. We price our services as a percentage of your net worth since we advise on your entire wealth picture, not just your investments.

Pricing this way also links the fees you pay to the value we provide because the larger your wealth picture, the more moving parts there are, and the more opportunities we have to optimize your finances.

Let's figure out if we're a good fit

Book a time for us to chat at your convenience.

We're still accepting new clients ...

But we won't always be. That's because we're building a community, not a client list. While many advisors work with hundreds of clients, we're capping our capacity at just 50 families so that we can maintain a high level of service and establish deeper and more meaningful relationships with our clients.

All of this means it is very important to us to find the right clients. You can learn more about who we work best with on the Who We Serve page. If you're still uncertain, please book a time for an intro consult. We would love to chat.

“Price is what you pay, value is what you get.”

Warren Buffett

What you get

Confidence

You can move forward confidently, knowing that all aspects of your wealth have been planned out and that your money will support your life goals. You will no longer have to wonder if you're making good money choices or whether your assets will be enough to achieve what you want. You'll know exactly where you stand and what steps we're taking to ensure you remain on track.

Time

As you gain comfort and trust in working with us, you’ll spend less time thinking and worrying about money choices. You'll know that we're there to advise you no matter what life throws at you. We will also work collaboratively with the other professionals you work with to save you from spending time and mental energy coordinating them all, and you'll be free to spend your time on the things that matter most to you.

Continuity

You will have a team who understands you and is looking out for your best interests. We will work collaboratively with your other professional advisors to optimize your wealth picture. This will make you more resilient to turnover or change in your team. And if anything were to happen to you, we’ll be there to ensure your loved ones are well-positioned to handle the hard financial choices they will face.

Growth

You've reached a point in life where you realize that wealth doesn't buy happiness and that fulfillment comes from growth (physical, intellectual, emotional and spiritual). Our goal is to help you use your wealth to experience life fully. We’ll spend time really getting to know you and helping you articulate a vision for your best life so that you can use the freedom money provides to grow into the best version of yourself. In other words, we want to maximize your return on life.

Impact

As your wealth has grown, you have decided that you'd like to use at least some of it to make a positive impact. But giving away your money isn't the only approach. We'll help you understand the various ways your wealth (time, talent, and treasure) can be used to do good. We'll help you understand new approaches to making an impact, like venture philanthropy, ESG investing, impact investing, etc., and help devise a strategy for how to maximize the positive impact of your wealth.